- About Us

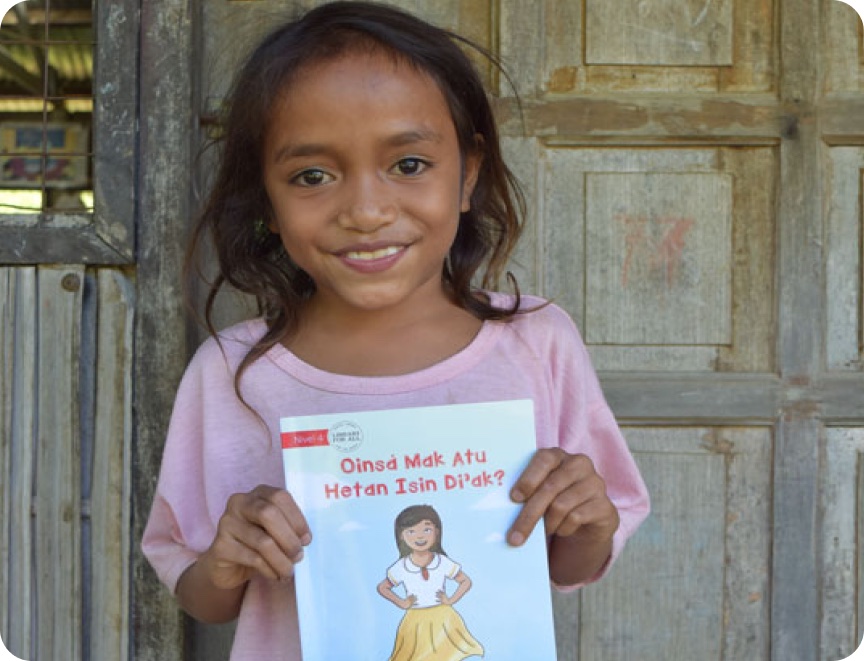

- About ChildFund Australia

- The Way We Work

-

Learn more about The Way We Work

- Where We Work

-

Learn more about Where We Work

- Frequently Asked Questions

- Policies & Guidelines

- Careers & Volunteering

- Information for Child Sponsors

-

Information for ChildFund Child Sponsors

- Contact Us

- Swipe Safe

- Our Impact

- Ways to Support

- Buy Gifts For Good

- My account